Oil refinery closures could see platinum returned to the market

As the number of coronavirus cases surges across Europe and the US, demand for refined petroleum products is taking another turn for the worse. Refineries are faced with huge overcapacity problems and more closures loom, but what does this mean for the platinum market?

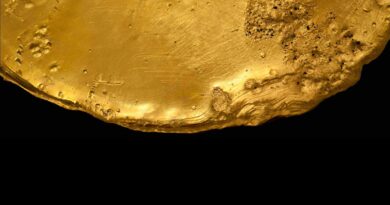

Platinum is the key active agent used in catalytic reforming to convert petroleum refinery naphthas from crude oil into high-octane liquid products. The leading reforming technology is known as continuous catalyst regeneration (CCR), whereby the catalyst is regenerated in situ on a continuous basis.

Platinum catalysts are also used to generate petrochemical feedstock, which is the raw material used for the manufacture of plastics, synthetic rubber and polyester fibres. The use of platinum as a catalytic agent in the petroleum industry was introduced by Universal Oil Products in its Platforming process in 1949.

Today, the majority of gasoline produced globally is derived from the same catalytic reforming process, and the industry is now one of the main industrial consumers of platinum annually.

Platinum is also combined with rhenium for improved performance and durability in certain applications.

Catalysts can have up to a 10-year life before recycling but require regular top-up which, along with new capacity, accounted for around 230 koz of platinum last year. Top-up requirements for catalytic reforming account for only a small proportion of annual demand, and therefore is unlikely to impact the price, particularly given the size of the platinum market.

However, changes in refining capacity levels, i.e. refinery closures or new capacity, could have a more noticeable effect on both the market and the price. The input for all petroleum refineries is crude oil, so refinery utilisation is intrinsically linked to both supply of crude oil and demand for petroleum products.

The impact of Covid-19 resulted in the sharpest downturn in energy and oil demand in living memory, and global oil demand is forecast to slump to 91.3 million barrels per day (bpd) this year, a reduction of 8.8 million bpd (-8.8%) from 2019 (source: IEA).

Demand is projected to recover modestly in 2021, by 5.8 million bpd to 97.1 million bpd, with economies such as India and China expected to perform better than initially estimated. However, this is still 3 million bpd below the pre-pandemic level of 2019.

After a price crash in April, when WTI closed in negative territory for the first time in history, oil prices have recovered over the past six months. However, the price remains very low by historical standards, and the fundamental outlook for the oil market is weak.

There is increasing pressure on producers to hold back even more output in an attempt to support prices. OPEC and Russia are already keeping more than 8 million bpd out of the market, enough supply to see the world comfortably return to pre-pandemic levels of demand.

Compounding the issue of oversupply from oil producers and weak demand for the end-products is the chronic structural overcapacity of refineries. Assumptions for end-product demand growth encouraged a ramp-up in investment in the refining sector over the past few years, with 2.2 million bpd of new refining capacity coming online in 2019 alone, including two mega refineries in China.

Even before the pandemic, net refining capacity was forecast to grow faster than demand for end-products in the near term, but the scale of the demand decline this year means that excess capacity looms, with more than 20 million bpd of crude distillation capacity currently idle (source: IEA).

While a low oil price is usually good news for refiners, the contraction in demand for petroleum products has squeezed refinery margins and volumes, putting increasing pressure on older, marginal and less competitive units.

Refinery utilisation rates sank to record low levels during the first half of 2020 as demand plummeted and stocks filled up. Throughput was reduced by nearly 12 million bpd in Q2’20 (source: OPEC), but it was not enough to prevent significant stock build-up.

However, some governments are hesitant to close refineries. With a fear of becoming more reliant on imported fuel, governments often encourage refineries to remain open. Earlier this month, Australia announced plans to invest A$211 m ($153.5 m) to subsidise the country’s four remaining refineries and improve fuel security.

Nevertheless, permanent refinery capacity closures for 2020-2021 have now risen to 1.7 million bpd, potentially returning around 170 koz of platinum to the market (~120 koz in the US alone). While there were some shutdowns already in the pipeline for this year, capacity curtailments are being hastened by the pandemic.

Earlier this month, Royal Dutch Shell announced it would halve processing capacity at its 500,000 bpd Pulau Bukom oil refinery in Singapore and several European refiners have announced similar plans.

Europe alone is estimated to lose around 2 million bpd of processing capacity by 2025 (-13%), equivalent to approximately 13 refineries (based on average refinery size in Europe) and returning a potential 225 koz of platinum to the market.

Older, marginal refineries are likely to remain at risk of closure as competition increases from more modern and complex refineries in Asia, whilst in Japan, lower domestic petroleum consumption (particularly gasoline) is expected to lead to additional government directives requiring refiners to cut excess capacity.

However, the rate of capacity cuts is likely to ease off by 2030, with the largest curtailments taking place in the early to mid-2020s in order to keep average utilisation rates at sustainable levels.

Greater usage of diesel and gasoil in marine fuels plus rising production of heavy commercial vehicles should drive diesel demand growth in the medium term, although growth will be hindered by lost consumption from declining diesel passenger car sales.

Meanwhile, expanding internal combustion engine (ICE) vehicle production as the world recovers from the pandemic should boost gasoline usage over the next few years, although higher penetration of electric vehicles (EVs), improving fuel economies and tightening emission standards will limit growth over the longer term.

An increasing number of countries are signalling their intention to phase out sales of ICE vehicles altogether (the most ambitious governments are aiming for 2025) and automakers are slowly shifting their product line-up away from combustion engines towards electrified models.

However, the EV transition will be a long and drawn-out process, with all internal combustion powered vehicles requiring fuel long after the ban on new ICE vehicle sales is implemented, thus generating (albeit reduced) demand for petroleum products from refineries.

Net petroleum requirements are predicted to slump by 55.8% (-126 koz) this year, owing to worldwide oil refinery closures plus slower utilisation as a result of Covid-19. Lower petroleum product (fuel) consumption globally, particularly of jet fuel, marine fuels and automotive fuels (i.e. gasoline and diesel), is likely to reduce full-year utilisation levels of petroleum refining units around the world, lowering catalyst use and hence top-up requirements in 2020.

Over the longer term (out to 2030), refinery throughput is forecast to grow at only half the pace seen over the last decade (source: IEA), reducing new catalyst demand. Unlike new openings or capacity expansions, closures or capacity reductions can be unpredictable and the release of platinum from what is a historically closed-loop system is a risk to the downside for an already oversupplied market.

Installed platinum in petroleum refineries is roughly equivalent to the annual production of platinum. Most of the time, this material is tied up in a closed-loop system, whereby the metal is used, recycled and regenerated, and does not re-enter the market. It is therefore not considered to be a traditional stock such as those associated with ETFs or inventories held by end-users.

However, with refinery closures forecast over the next few years as the downstream sector adjusts to the shocks in 2020, a return of platinum to the market should be expected in turn. Capacity growth and project investment are also forecast to continue declining out to 2025, which will see less platinum demand for reforming catalysts, and reduced utilisation rates are likely to generate weaker top-up demand.

While platinum demand is predicted to rebound next year owing to delayed projects, the longer-term outlook for the petroleum sector will be negatively affected by the events of 2020 for years to come.

Source: HERAEUS PRECIOUS METALS