Paladin ready to supply recovering uranium market

Paladin Energy Ltd has restarted its Langer Heinrich Mine during the 2nd quarter confirming restart capital, costs and operational performance.

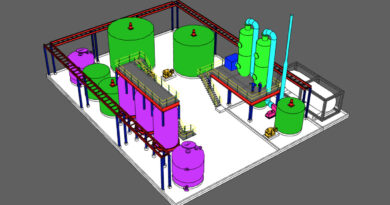

Paladin is a uranium production company with its producing mine in Namibia and exploration projects in Australia and Canada.

Paladin Energy has 75% stake in the Langer Heinrich Mine in Namibia. Langer Heinrich is a globally significant, life-long operation, having already produced over 40 million pounds of U3O8 to date.

The Restart Plan has a low restart capital intensity (US$14/lb) and competitive C1 Cost of Production (US$27/lb) and confirms the Langer Heinrich Mine is well positioned alongside other Tier 1 operations to deliver product into a recovering Uranium market.

The Company continues to monitor the uranium price and market, with an ultimate view towards securing uranium term-price contracts with sufficient term and value to underpin the restart of the Langer Heinrich operation.

Paladin placed its Langer Heinrich Mine on care and maintenance due to the sustained low uranium spot price and to preserve resource and shareholder value.

However, in March 2019 Paladin commenced feasibility studies aimed at re-positioning the Langer Heinrich operation for a restart when a suitable uranium incentive price is reached and to develop opportunities to reduce operating costs and potentially recover vanadium.

The company says no lost-time injuries or reportable environmental incidents were recorded during the quarter.

Paladin Energy implemented appropriate protocols across all locations to minimise the potential transmission of COVID-19, with no reported confirmed cases to our people, or onsite contractors.

Paladin continues to focus on minimising expenditure whilst progressing work packages at the Langer Heinrich Mine.

The Company’s guidance for FY2021 total expenditure is US$9.5M, a 44% reduction from FY2020.

Beyond Langer Heinrich, the Company also owns a large global portfolio of uranium exploration and development assets.