Pan African received funds for long-life Egoli project

Pan African Resources, in its Provisional Summarised Audited Results For The Year Ended 30 June 2020 has reported that the gold production increased by 4.1% to 179,457oz after final refinery adjustments (2019: 172,442oz), exceeding the revised full-year production guidance of 176,000 oz.

Revenue increased by 25.9% to US$273.7 million (2019: US$217.4 million). Profit after taxation increased by 16.6% to US$44.3 million (2019: US$38.0 million). Headline earnings increased by 93.0% to US$44.2 million (2019: US$22.9 million).

Net cash generated by operating activities increased by 42.7% to US$53.8 million (2019: US$37.7 million). Low-cost operations (including Elikhulu, BTRP and Barberton Mines’ Fairview Mine) achieved an all-in sustaining costs (AISC) of US$826/oz for the Reporting Period.

The development of Evander Mines’ Egoli project has commenced. The project’s payback is estimated at less than five years from inception of construction, with funding provided on a non-dilutive basis by means of a dedicated debt facility.

Production guidance increased to 190,000oz for the year ending 30 June 2021.

CHIEF EXECUTIVE OFFICER’S STATEMENT

“Over the past year, our Group’s operations demonstrated their resilience, with gold production in excess of the revised guidance for the year ended 30 June 2020 (Reporting Period). This operational performance was achieved despite the impact of the COVID-19 pandemic and the resultant restrictions imposed to curb the spread of the virus – a testament to the robustness and operational flexibility of our diversified portfolio of assets.

Gold production from Elikhulu and the Barberton Tailings Retreatment Plant (BTRP), our low-cost surface retreatment operations, have contributed significantly to the profitability of the Group and demonstrated the benefit of multiple producing operations.

We are pleased to confirm that we remain firmly on track to deliver into our guided gold production of 190,000oz for the year ending 30 June 2021, a substantial increase compared to the revised production guidance of 176,000oz for the Reporting Period.

We successfully levered the Group’s operational execution capability to bring Evander Mines’ 8 Shaft (8 Shaft) pillar project and the Prince Consort (PC) Shaft’s Level 42 development at Barberton Mines’ New Consort Mine into steady-state production, and these operations are now an integral part of our strategy to further reduce costs and increase margins at our underground mines.

Our Group’s safety performance during the Reporting Period is commendable and we will remain unrelenting in the pursuit of our ultimate goal of zero harm in the years ahead.

Pan African’s earnings for the Reporting Period were adversely affected by COVID-19. This impact was however largely offset by the robust gold price and by our ability to expeditiously ramp up gold production, in line with government directives, post the initial hard lockdown period. Despite the impact of COVID-19, we are pleased to report increased earnings for the Group this year.

We reduced net debt during the Reporting Period by 41.2% to US$76.4 million (2019: US$129.9 million), which resulted in a significantly improved net debt to net adjusted EBITDA ratioAPM of 0.7 (2019: 2.2).

Group all-in sustaining costs (AISC) of US$1,147/oz includes realised hedge losses of US$12.0 million. Excluding these realised losses, the Group’s AISC decreased to US$1,078/oz (2019: US$988/oz), which is more reflective of the actual operational costs and in line with the Group’s targeted AISC of US$1,000/oz. The AISC for the Group’s low-cost operations, comprising Elikhulu, BTRP and Barberton Mines’ Fairview Mine, was US$826/oz for the Reporting Period.

We believe the Group is well on track to produce at an AISC of below US$1,000/oz for the 2021 financial year.

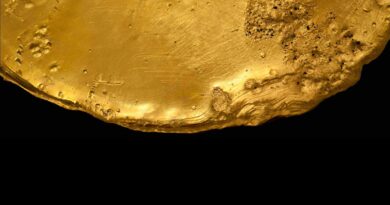

The Group will continue to invest in our compelling organic growth projects, most notably the recently announced long-life Egoli project, which capitalises on the substantial existing shaft and plant infrastructure, and is also fully licenced and ‘shovel-ready’.

We are pleased to announce that following the successful completion of the feasibility study, the Group has obtained credit approval from Rand Merchant Bank for the full debt funding of the project’s capital expenditure.

We have prioritised our environmental, social and governance initiatives, as evidenced by the level of rehabilitation spend for the Reporting Period, and board approval for the implementation of a number of significant and sustainable development projects. These include the 10MW renewable energy solar photovoltaic plant at Elikhulu and a large-scale agriculture project at Barberton Mines. The merits of a similar solar photovoltaic plant are also being considered for Barberton Mines, as well as new agriculture projects on rehabilitated land at Evander Mines.”