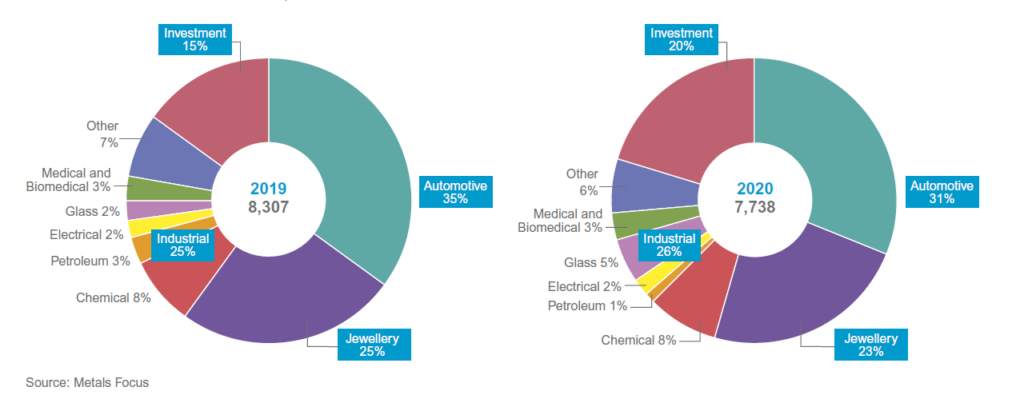

Platinum demand in Q4-2020, was 18% higher than in Q4-2019

The precious metal deemand in Q4-20, was 18% (+299 koz) higher than in Q4-19. Automotive and jewellery demand reflected the continued economic recovery in the quarter, while most of the remaining segments of demand remained below pre-pandemic levels. Platinum investment was up 63% (+51 koz) on Q4’19, however it was 86% (-827 koz) lower than in Q3’20, as ETF investments slowed, and the extensive exchange stock inflows of previous quarters halted.

AUTOMOTIVE DEMAND

Automotive demand in Q4-20 grew 5% (+31 koz) due to a healthy recovery in both light-duty and heavy-duty vehicle production. While light-duty vehicle production was up 4% year-on-year, overall diesel light vehicle production was down by 2%.

However, production trends varied substantially on a regional basis. A decline of 10% in diesel unit production in Europe resulted in an 8% (-26 koz) reduction in platinum demand, partially offsetting growth seen in other regions.

In North America, despite a slight decline in regional production, platinum demand increased 17% (+13 koz). Though diesel light-duty vehicle production is only a small share of the overall US market, output increased 37% in Q4’20, helping to offset the declines in other regions.

As passenger car manufacturing in countries such as Brazil and Mexico also stabilised, growth in the production of diesel units outpaced other fuel types, contributing to the 10% (+14 koz) growth in platinum demand from other regions.

Gains would have been higher, were it not for offsetting losses in some other markets, notably India which saw diesel vehicle production decline by 11%. Global production in heavy-duty vehicles increased by 7%, spearheaded by China increasing by 21%.

With the target date for China VI (heavy-duty) compliance fast approaching, an estimated 20% share of production was fitted with the heavier PGM loaded catalysts, contributing, along with higher unit production, to the 51% (+29 koz) increase in platinum demand from this region.

JEWELLERY DEMAND

North American fabrication demand in Q4-20 saw its first year-on-year increase for the year, of 4% (+4 koz). Pandemic-driven restrictions on travel and leisure activities resulted in some expenditure diversion towards jewellery.

Moreover, the emotional impact of the pandemic resulted in consumers choosing platinum for special occasion gifting, particularly over the festive season. This also benefited from platinum’s still historically favourable pricing compared to gold. Fabrication would have been even higher, had retailers not trimmed stock levels as they did.

European demand in Q4-20 continued its recovery from the Q2-20 trough, registering a modest improvement of 2% (+1 koz). This was mainly as high-end jewellery and watch brands benefitted from improving sales into East Asia, plus some re-stocking by retailers. Bridal jewellery sales in contrast remained sluggish.

China’s platinum jewellery fabrication demand in Q4-20 was 15% (+31 koz) higher than Q4-19. Compared to the prior quarter however, we saw demand soften. While buying was still strong in October, it softened in November and December, as platinum prices increased, and seasonally driven gold interest started to overshadow interest in platinum jewellery.

With Chinese New Year approaching, retailers directed marketing activities more towards gold than platinum.

In India, despite the onset of the wedding season, platinum jewellery fabrication fell by 25% (-7 koz), recording its fourth consecutive quarterly drop. Fabrication continued to underperform consumption as retailers remained cautious about building inventory.

Importantly, unlike gold, which is the preferred choice for weddings, there has been only a limited recovery in platinum jewellery demand as consumer buying remains need-based. In addition, the impact of the pandemic on disposable income meant that purchases have been heavily curtailed.

INDUSTRIAL DEMAND

Industrial demand in Q4-20 was 43% (+184 koz) higher than in Q4-19 and 20% (+103 koz) above Q3-20. However, these increases result primarily due to very strong glass demand, which offset year-on-year declines in the balance of industrial end-uses, which, despite showing significant quarter-on-quarter improvement, still remain below pre-pandemic levels.

PETROLEUM

Platinum demand in Q4-20 was higher than the previous two quarters but was 31% (-17 koz) below pre-COVID-19 levels as widespread refinery closures in North America and other regions comfortably offset the return to more typical levels in China where significant capacity expansions continued in Q4-20.

North America and other regions continued to suffer from the deep impact of their oil sectors’ challenging year. In particular, the closure of several refining complexes in North America contributed to regional platinum demand being close to zero in Q4-20.

Elsewhere, top-up catalyst demand in Europe showed a modest decline of 2% (-0.06 koz), while Japan increased by 6% (+0.1 koz).

CHEMICAL

While still 9% (-18 koz) below Q4-19, platinum chemical offtake grew by 43% quarter-on-quarter to 176 koz in Q4-20. To a large extent, gains compared with Q3-20 were led by new paraxylene (PX) capacity expansion in China.

China Sinochem Group commissioned a new crude processing unit and a petrochemical complex (including a new 800,000 tonnes/year PX facility) in Quanzhou in December, with trial operations already starting in early 2021.

On the other hand, PX producers outside China continued to grapple with reduced operating volumes and ongoing margin pressures, amid rapid capacity expansion in China in recent years and weak downstream demand.

Platinum use in silicone also continued to recover in Q4-20. The worsening of COVID-19 infections saw increased use in medical, health and hygiene applications. Meanwhile, the ongoing recovery in economic activity, at least in the early part of Q4, also supported demand from other areas, such as construction and automotive.

Finally, continuing the trend in the previous quarter, production of nitric acid suffered limited impact from the pandemic as most countries designated the agricultural sector (including fertiliser production) as essential and therefore exempt from business closures and restrictions on movement.

MEDICAL

After a strong rebound in October, demand from the medical device sector reduced as the second COVID-19 infection wave resulted in a slowdown in elective procedures and postponements of non-urgent procedures in November and December.

This, together with a similar reduction in cancer treatments, resulted in a 5% (-3 koz) decline in platinum demand. Europe and North America reduced the most, but all regions reported a decline.

GLASS

Platinum demand from the LCD substrate and glass-fibre industry continued to recover in Q4-20, reaching 163 koz. This compares with a negative net figure (-65 koz) in Q4-19, the result of major decommissioning of LCD furnaces in Japan and for Q4-20 mainly because most planned new capacity expansions are going ahead despite COVID-19, albeit with some delays.

ELECTRICAL

The electronics segment declined modestly in Q4-20 by 3% (-1 koz) year-on-year to 35 koz, buoyed by the resumption of HDD shipments to key sectors. The extension of work-from-home and distance learning sustained strong use of hard drives in the consumer electronics market.

However, the delays in data centre expansion caused by the pandemic weighed somewhat on orders from this segment. Demand from surveillance and enterprise recovered from their weak Q3-20 performance, but stayed low compared

to prior year, as economic uncertainties brought about by the pandemic favoured increased cost conservation.

OTHER

Demand from the other industrial segment in Q4-20 was 5% higher on Q3-20 in line with increased automotive production and platinum used in non-autocatalyst vehicle applications. This was supported by growing deployment of platinum-based electrolysers to produce green hydrogen from mainly wind and solar renewable power sources and use stationary fuel cell applications.

However, despite the increased contribution from these applications to demand, overall offtake was still 3% (-5 koz) below pre-pandemic Q4-19 levels.

INVESTMENT DEMAND

During Q4’20, global bar and coin demand more than doubled year-on-year to 60 koz. The strength reflected a much-improved demand in North America, while net sales in Japan and Europe were little changed compared with Q4’19.

However, buying was sharply weaker quarter-on-quarter, falling by 38% as a result of Japan swinging from modest net investment during the July to September period to modest net selling in the fourth quarter.