Eastern Platinum reports results for the second quarter of 2022

Vancouver, British Columbia – Eastern Platinum has reported that revenue for Q2 2022 increased to $20.5 million (Q2 2021 – $20.0 million), representing a 2.5% increase. Revenue for YTD 2022 increased to $37.9 million (YTD 2021 – $36.7 million), representing a 3.4% increase.

Mine operating income increased by $0.9 million (or 25.2%) to $4.2 million in Q2 2022 (Q2 2021 – $3.3 million), resulting in an improved gross margin of 20.3% in Q2 2022 from 16.6% in Q2 2021. Mine operating income in YTD 2022 increased by $2.8 million (or 59.1%) to $7.6 million (YTD 2021 – $4.8 million), resulting in an improved gross margin of 19.9% in YTD 2022 from 13.0% in YTD 2021.

The Company had positive working capital (current assets less current liabilities) of $16.1 million as at June 30, 2022 (December 31, 2021 – $14.6 million) and short-term cash resources of $6.4 million (consisting of cash, cash equivalents and short-term investments) (December 31, 2021 – $6.1 million).

OPERATIONS

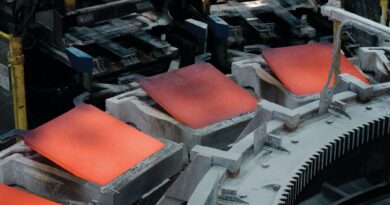

The Company continues its Retreatment Project at Barplats Mines (Pty) Limited’s tailings facility (the “Retreatment Project”) located at the CRM in South Africa.

The majority of the Company’s revenue (approximately 84% for Q2 2022) is generated from the offtake agreement with Union Goal Offshore in relation to chrome concentrate production from the Retreatment Project. The remaining amount of the Company’s revenue was from PGM concentrate sales to Impala Platinum.

The Company is currently owed approximately $17.0 million from Union Goal in accounts receivable from processing and dispatching chrome concentrate in addition to $6.0 million for chrome concentrate not yet invoiced as of the date of this news release.

Payments against the outstanding receivable from Union Goal have been slow despite repeated requests for a payment plan. Management is in the process of evaluating and communicating with Union Goal to determine an agreeable outcome.

A default on the receivable or lack of payment from Union Goal could have a significant impact not only on the instrument credit risk adjustments recorded to date but on the Company’s liquidity as a whole. Further delays in payment may require the Company to re-evaluate the fair value of the contract payable, re-evaluate the value of the contracts to the parties, and could lead to a renegotiation/change of the Union Goal contracts, including target completion dates for the optimization program. The Company still expects to receive all monies owed to it and will pursue all commercial options available to it to collect these amounts. The Company will continue to keep the shareholders informed of these risks and the Company’s chosen course of action in due course.

The PGM Circuit D and PGM Main Circuit B continue to drive revenue growth and gross margin improvement for the Company.

Wanjin Yang, Chief Executive Officer and President commented, “The Q2 financial results have shown the Company is on the right path to continue its revenue growth and profitability improvements from the Retreatment Project and capacity increases from the PGM circuits. We are also focused on achieving a commercial result to reduce Union Goal’s outstanding receivables.”

OUTLOOK

The Company’s targets for 2022 are as follows:

- Operate and optimize the Retreatment Project and maximize returns (ongoing)

- Completion of the Optimization Program for the Retreatment Project (ongoing)

- Assess the value for continued use of the chrome recovery plant after optimization (ongoing)

- Operate and optimize the PGM Circuits (ongoing);

- Complete an updated independent technical report on the CRM (completed);

- Raise capital to restart Zandfontein underground operations at the CRM (ongoing);

- Complete the second phase of the tailings storage facility (“TSF”) capital works program (ongoing);

- Advance the Mareesburg project environmental work to complete the legal analysis on the

- Environmental Impact Assessment (“EIA”) and other environmental studies and amendments (ongoing);

- Continue prospecting and assessment work in relation to Zandfontein, Crocette and Spitzkop ore bodies (ongoing);

- Complete EIA and assessment work regarding a vertical furnace and pelletizer of chrome concentrate (ongoing); and

- Update other capital assessments upon completion of capital fundraising.

Eastplats owns directly and indirectly a number of PGM and chrome assets in the Republic of South Africa. All of the Company’s properties are situated on the western and eastern limbs of the Bushveld Complex, the geological environment that hosts approximately 80% of the world’s PGM-bearing ore.

Operations at the Crocodile River Mine currently include re-mining and processing its tailings resource to produce PGM and chrome concentrates from the Barplats Zandfontein tailings dam.