SEIFSA: Eskom cannot provide sufficient electricity to its customers

SEIFSA Chief Operating Officer Tafadzwa Chibanguza notes with grave disappointment the significantly above inflation tariff increase granted by the National Energy Regulator South Africa (NERSA) to Eskom. Increases of this magnitude only add to the already high cost of living endured by many South Africans, as well as raising the cost of doing business.

While it is acknowledged that NERSA has a very difficult balancing act to manage, which amongst other, includes ensuring the sustainability of the electricity utility, the timing of the increase is extremely unfortunate.

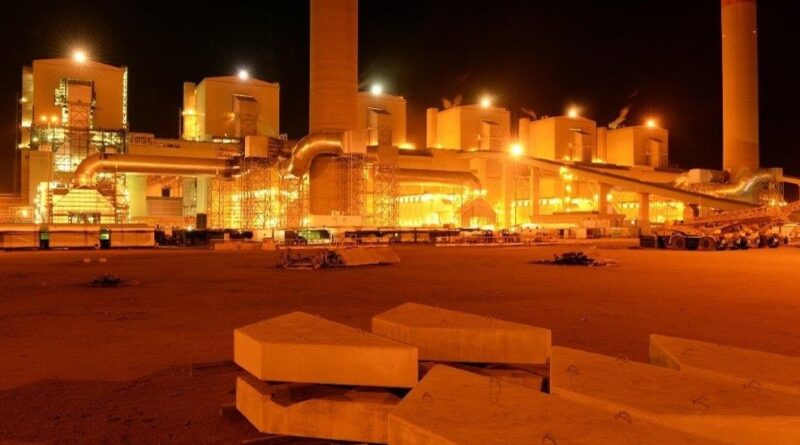

The increase is granted at a time when Eskom cannot provide sufficient electricity to its customers, a situation which is expected to continue into the foreseeable future. The indefinite declaration of stage six power cuts, with customers not having electricity for anything between 10 and 12 hours a day, is extremely damaging to businesses and the economy.

The fact that companies must make alternative plans for electricity during periods of loadshedding, like running generators where the cost can be anything from 3 – 3.5 times more per kilowatt hour than the Eskom tariff, means that the effective increase to customers is much more than the 18.65% and 12.74% granted for the 2023/4 and 2024/5 years, respectively.

For the metals and engineering sector value chain, which is made up of energy intensive upstream industries and relatively less energy intensive downstream industries, the implication of this tariff increase is extremely damaging.

The cost of alternative energy solutions for the energy intensive upstream industries is extremely prohibitive, given their consumption, resulting in these industries being bound to Eskom and exposed to the punitive cost increases. While the downstream industries that are relatively less energy intensive are able to make provision for alternative energy solutions, the cost of running these alternatives is equally prohibitive.

Apart from the fact that the energy crisis detracts from the investment attractiveness of South Africa, a very concerning long-term implication is emerging.

Companies are sacrificing long-term capital that could otherwise be invested in expanding their operations and are spending these scarce resources in pursuit of immediate survival. The long-term implications will be a continued structural decline in the performance of the metals and engineering sector, which has already been tracked at a rate of 1.6% on a compound annual basis since 2008. Employment in the sector, especially among woman and youth, has contracted at the same pace over the same period, contributing to the socio-economic calamity that the country already faces.

Only a clear, honest and dogmatic focus on structural reform in the energy sector will move the country out of this crisis. While multiple efforts in this regard, including the reforms announced by the President in July 2022, are welcome and present a fundamental shift to the management of the electricity supply industry, progress to date has been painfully slow.

The level of the crisis and the risk to the economy requires a response as aggressive as the response to the Covid-19 pandemic. The supply of reliable, consistent and efficiently priced electricity is not only in the best interest of the private sector but the entire South Africa. Therefore, private sector involvement in the provision of electricity should be expedited without restriction and delay.