Sibanye-Stillwater: Marikana integration has contributed positively

Sibanye-Stillwater has reported operating and financial results for the six months ended 30 June 2020. The Group delivered solid operating results for the six months ended 30 June 2020 (H1 2020), with production from all the operating segments increasing year-on-year despite the challenges and disruptions posed by the global COVID-19 pandemic.

Along with significantly higher precious metal prices received for the period, the operational results underpinned a robust financial performance from the Group with record six-month adjusted EBITDA of R16,514 million (US$990 million) for H1 2020, 718% higher than for the comparable period in 2019, attributable profit of R9,385 million (US$563 million) compared with a R255 million (US$18 million) loss for H1 2019.

Normalised earnings of R8,845 million (US$531 million) and free cash flow of R10,921 million (US$655 million), facilitated continued delivery on Sibanye’s strategic imperatives, specifically, ongoing reduction of debt and balance sheet leverage to 0.55x net debt: adjusted EBITDA, well below 1x internal target, and the resumption of cash dividends, with a R1,338 million interim dividend (US$79 million at US$/R16.97) declared based on the current shares in issue.

COVID-19

The continued improvement in the Group safety performance and the substantial financial and social assistance provided to employees and their communities has complemented the operating and financial performance delivered during the period.

Sibanye-Stillwater committed over R1.5 billion in financial support to employees not at work during the period and over R100 million committed to community and government support.

The continued improvement in Group safety performance for H1 2020 is noteworthy and achieved in exceptional circumstances, with adjustment to protocols and distractions caused by COVID-19 resulting in reduced levels of production in South Africa for a substantial portion of the second quarter.

Safe production milestones included the Group recording its first fatality free quarter (Q2 2020) since Q4 2018, with the SA gold operations achieving a remarkable deep level hard rock safe production milestone of 12.4 million fatality free shifts by the end of H1 2020.

US OPERATIONS

The US PGM operations reported 2E PGM production of 297,740 2Eoz which was 5% higher than for H1 2019, with recycled production of 397,472 3Eoz 6% lower, primarily due to a global slowdown of auto catalyst collections and deliveries and logistical constraints caused by the global imposition of COVID-19 restrictions.

Although the US Region was able to continue operating during the COVID-19 pandemic, the pandemic has resulted in further cost inflation. Since March 2020, the Region has incurred approximately US$3 million in COVID-19 related expenditure.

Given the delays caused by COVID-19 along with improved geological and geotechnical knowledge gained as a result of new development and drilling, a review of the ramp up schedule is being conducted.

Early indications are that the Blitz project will be delayed by up to 18 months. Further detail will be provided once the study has been concluded. The Fill the Mill project (FTM) is advancing according to schedule and within budget, with an annualised steady state production run rate of 40,000 2Eoz expected from October 2020. This project is expected to yield an NPV of over US$400m and an IRR of 124% at spot 2E PGM basket price.

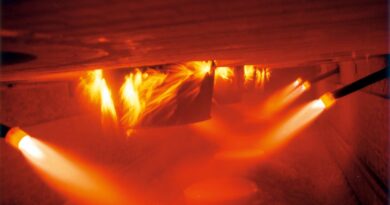

SA PGM OPERATIONS

4E PGM production from the SA PGM operations increased by 5% year-on-year to 657,828 4Eoz, with the inclusion of the Marikana operations for the full six-month period offsetting lost production due to COVID-19 disruptions.

AISC of R19,277/4Eoz (US$1,156/4Eoz) were 46% higher year-on-year, predominantly due to significantly lower production in Q2 2020 resulting from COVID-19 related disruptions and the inclusion of relatively higher cost Marikana production (due to entirely conventional production, which is higher cost relative to the significant amount of lower cost mechanised production at Rustenburg and Kroondal and the cost of the Marikana smelting and refining operations) which comprised 42% of production for the period compared with 13% for H1 2019.

The integration of Marikana has continued to progress positively, with the Marikana operation contributing R3,943 million (US$237 million) or 44% of total adjusted EBITDA from the SA PGM operations for H1 2020.

Identified annual synergies from Marikana have more than doubled from initial estimates of approximately R730 million per annum, to an estimated annual run rate of up to R1.85 billion in annual synergies by the end of 2020.

SA GOLD OPERATIONS

Production from the SA gold operations of 12,554kg (403,621oz) for H1 2020 was 17% higher than for the comparable period in 2019, with AISC decreasing by 8% to R800,048/kg (US$1,493/oz) compared to the same period in 2019, which was impacted by the AMCU strike across the managed SA Gold operations (excluding DRDGOLD).

Gold production from the managed gold operations (excluding DRDGOLD), increased by 24% to 10,167kg (326,877oz) compared to the same period in 2019 despite the disruptions caused by the national COVID-19 lockdown, largely reflecting the operational recovery post the AMCU strike in H1 2019.

The COVID-19 disruptions affected most of the April 2020 milling period with a steady build-up from May into June. By the end of June almost 70% of the crews had returned to work and were operating at slightly above planned efficiency levels.

Despite significantly lower production due to the COVID-19 disruptions in Q2 2020, AISC from the managed SA gold operations decreased by 14% to R846,741/kg (US$1,580/oz) compared to the same period in 2019.

However, due to the COVID-19 disruptions, actual AISC remains well above company’s AISC forecast that would be expected under normalised production conditions.