What can we expect from platinum this year?

As the year progresses, market focus will be on the rate of recovery and the extent to which a return to “normal” economic conditions can be achieved. Aside from the COVID-19 pandemic that will potentially leave indelible scars on many industries, there were and are many other factors that will likely influence demand for platinum.

The cooling of the global economy, that was already underway before the COVID-19 crisis, the evolution of the trade war between the US and China, Brexit, the Russia-Saudi Arabia fall-out (in terms of oil production) all contribute to an outlook that is dramatically different from the prior year.

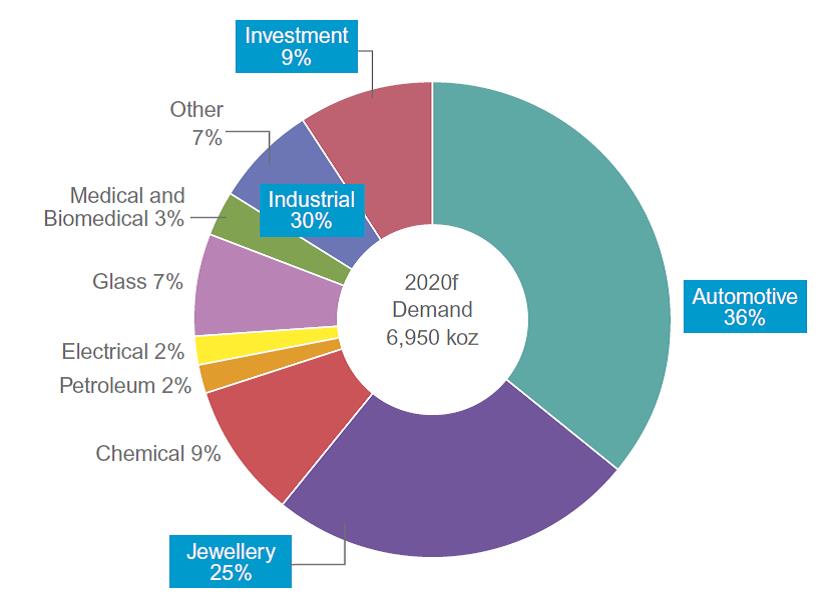

In 2020, global supply is forecast to be 7,197 koz, comprising refined mining production of 5,287 koz and 1,910 koz of recycling supply. Set against this, demand will be 6,950 koz, consisting of 2,481 koz of autocatalyst demand, 1,785 koz of jewellery demand, 2,080 koz of industrial demand and 605 koz of investment demand. On the back of these supply-demand dynamics, the platinum market in 2020 is forecast to shift from a deficit of 168 koz in 2019 to a surplus of 247 koz.

Supply

The impact of COVID-19 on the operating environment across much of the mining industry has introduced extreme forecast risk.

Uncertainty surrounding country lockdowns, workforce social distancing measures and the risk of additional closures due to infections at mine sites has resulted in several producers withdrawing production guidance.

Those that have maintained guidance highlight the fluidity of the situation and caution downside risk.

With those caveats in mind global refined production is forecast to fall 13% (-807 koz) to 5,287 koz in 2020. South Africa represents the bulk of the decline, with supply forecast to fall 17% (-753 koz) to 3,649 koz with at least 500 koz (in isolation) of supply lost due to the Anglo American Platinum Converter Plant (ACP) shutdown and further losses as a result of reduced production due to COVID-19-related restrictions.

Zimbabwean supply is forecast to decline a more modest 4% (-18 koz) to 438 koz. Mining operations have received dispensation to continue limited production over the lockdown period, but with country’s output dependant on South African refineries, logistical

challenges remain.

Supply from North America is forecast to remain broadly flat. Impala Platinum’s Canadian operations have been placed on care and maintenance due to COVID-19 and growth at Sibanye-Stillwater’s US operations has been deferred.

Russian supply is forecast to fall 4% (-27 koz) to 689 koz due to planned smelter maintenance at Nornickel.

Producer inventory is expected to remain unchanged as any build-up due to COVID-19-related logistical challenges are expected to be cleared before year-end.

Recycling

This year, we expect autocatalyst recycling to fall by 7% (-122 koz) to 1,508 koz. Despite the expected decline this will still be the second highest total on record.

The key issue driving this outcome will be the impact of the COVID-19 pandemic on automotive sales and, in turn, the expected drop in recycling as consumers delay trading-in their existing vehicles.

However, there will be some offset as the decline in receipts by refiners and smelters allows the trade to process any backlogs of accumulated material. Furthermore,

as scrapyards contend with lower receipts of end-of-life vehicles, the financial pressures this creates may result in a quicker pace of destocking of existing vehicles and parts held by scrap yards.

Importantly, we believe this decline will not be repeated in 2021, when the growth in platinum autocatalyst recycling is forecast to return to levels more typical of recent years. Jewellery recycling for the full year is expected to decline by 28% (-132 koz), largely driven by consumer’s response to the prevailing price level.

Demand

In 2020 demand for platinum is forecast to decrease from 8,430 koz to 6,950 koz, representing a reduction of 18% (-1,480 koz).

Automotive demand is expected to fall by 14% (-413 koz), jewellery demand by 15% (-315 koz) and industrial demand by 5% (-104 koz), notwithstanding the healthy increase in glass demand of 58% (+175 koz). Investment demand is forecast to be 605 koz.

Platinum 2020 demand forecast