Australia aluminium smelters suffer from one of the highest power cost

Year 2020 marked the 65th birthday of the Australian aluminium industry. The southern hemisphere’s first aluminium smelter was built at Bell Bay in northern Tasmania to overcome national security risks following the second world war and is still operating.

At present, Australia’s aluminium industry directly employs more than 15,000 people and indirectly supports around 40,000 families in regional Australia.

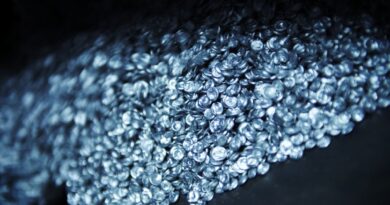

The Australian industry now comprises of five large (>10 Mt per annum) bauxite mines, six alumina refineries and four aluminium smelters; in addition to downstream processing such as extruders and distributors.

Australia is the world’s largest producer of bauxite, collectively producing more than 100 Mt of bauxite per annum; the world’s largest exporter of alumina, exporting more than 17 Mt per year; and the sixth largest producer of aluminium.

The world watched in the first half of 2020, as aluminium prices collapsed because of COVID-19. Demand for aluminium in cars, aeroplanes and construction plummeted. There was also concern that Australia’s operations would be faced with shutdown as a result of lockdown measures in each jurisdiction.

But while the country has faced challenges of restricted regional movement, all operations remained open throughout the year and production from Australia’s bauxite mines and alumina refineries has actually increased.

Whereas aluminium prices have now largely recovered, the longer-term future of industry will depend on the rate of recovery of the global manufacturing sector and the impact this has on international demand.

The crisis reinforced the advantages economic self-sufficiency—of being able to value-add within a domestic supply chain—from Australian bauxite, to Australian alumina, to Australian aluminium and on to Australian extruders.

All four smelters consume more than 10% of electricity demand. Australia’s aluminium smelters have been increasingly called upon to support grid stability and reliability to fill this role.

Their large and fast-acting interruptibility helps secure and restore stability to the network, particularly on those hottest of hot days in summer when the demands of the network are pushed beyond their capability. Or when network conditions deteriorate, as a result of bushfires or other conditions and significant load shedding is required to restore its strength.

Smelters also provide critical, stable demand all day, every day. But each interruption presents a process risk to a smelter to safely restore their own stability as they resume production.

Electricity accounts for around 30-50% of Australian aluminium smelters’ total cost base and is a key determinant of their international competitiveness. The delivered cost of electricity in Australia has, in recent times, been consistently priced in the highest (fourth) quartile of global prices.

These system shocks have caused high volatility in spot prices over recent years, which has been a key driver in the increased cost of wholesale electricity contracts. Compounded by this volatile electricity market, the circumstances are now urgent for Australia’s four smelters.

Smelters seeking to recontract today are facing difficult decisions, especially under current economic conditions. But without Australia’s aluminium smelters, the challenge to manage the electricity market and reliably supply the 22 million Australians connected to it, is even harder.