BHP fights potentially lost battle for copper, nickel, PGM company

BHP’s proposed acquisition of Noront has come to a standstill, for now. The mining major has been bidding against Australia’s Wyloo to acquire Canadian miner Noront.

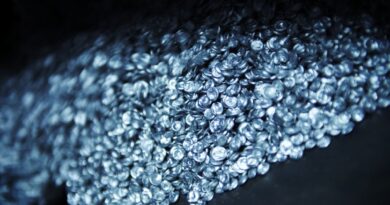

Noront is in process to develop its copper, nickel, platinum and palladium deposit, which ranks it definitely in the Green Metals category and makes it desired property at this point in time. Noront also has chrome ore deposits with impressive names such as Blackbird, Black Thor and Big Daddy, all located in the Ring of Fire.

The corporate battles also feel like a ring of fire currently. Wyloo is the largest shareholder in Noront and has increased its bid for Noront to CAD1.10 per share. BHP is offering mere CAD0.75 per share and requires at least 50% of shareholders to accept the offer.

Wyloo’s stake is 37%, so the refusal by the Australians to accept the offer (and even worse – to make a much higher offer) is now a major hurdle for the BHP board. Nevertheless, BHP has the support of Noront’s board of directors, which has encouraged shareholders to accept the offer from BHP.

This is a key transaction for BHP as it looks to move further into the green metals space. The move away from fossil fuels is being assisted by the deal to merge its oil and petroleum business with Woodside, thereby creating one of the largest independent energy companies in the world.

Noront shareholders have until 14th January to accept BHP’s offer. The share price has climbed to CAD0.70 off the back of Wyloo’s increased offer.