Cannington zinc grades more than offset lower silver and lead grades

South32 has reported that Cannington payable zinc equivalent production increased by nine per cent (or 19.8kt) to 238.0kt in FY20 as planned higher zinc grades more than offset lower silver and lead grades, and the operation drew down run of mine stocks to a normalised level following the Queensland flood event in FY19. The drawdown and further improvement in underground mine performance supported the realisation of efficiencies in mill throughput, resulting in a 14 per cent lift in ore processed during FY20.

Located in north-west Queensland, Cannington is 100 per cent owned by South32 and is one of the world’s largest producers of silver and lead.

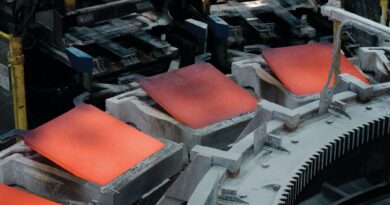

Cannington consists of an underground hard rock mine and surface processing facility, a road-to-rail transfer facility and a concentrate handling and ship loading facility at the Port of Townsville.

Silver, lead and zinc are extracted from the ore using grinding, sequential flotation and leaching techniques that produce high-grade, marketable lead and zinc concentrates with a high silver content.

OPERATING COSTS

Operating unit costs decreased by eight per cent to US$113/t in FY20 as the benefits of a weaker Australian dollar, increased mill throughput and savings from the insourcing of activity more than offset inventory movements.

FINANCIAL PERFORMANCE

Underlying EBIT increased by one per cent (or US$1 million) in FY20 to US$105 million as higher sales volumes (+US$45 million), a weaker Australian dollar (+US$16 million), lower freight expenditure (+US$5 million) and a reduction in contractor costs (+US$5 million) offset lower average realised prices (-US$36 million) and inventory movements from higher sales and the drawdown of run of mine stocks (-US$43 million).

CAPITAL EXPENDITURE

Sustaining capital expenditure decreased by US$3 million in FY20 to US$52 million.