Eskom happy with slow carbon tax rollout

South Africa’s government has decided it would extend the first phase of its carbon tax plan by three years, which could delay an increase in rates for companies including coal-reliant state power utility Eskom. Increases to carbon tax from 2026 are compatible with targets to reduce emissions, says Forestry, Fisheries and Environmental Affairs Minister Barbara Creecy.

Eskom has assessed an annual carbon-tax bill of around R11.5 billion when exemptions run out at what was supposed to be the start of the programme’s planned second phase in 2023. The initial period will now be extended to the end of 2025, according to the Finance Minister.

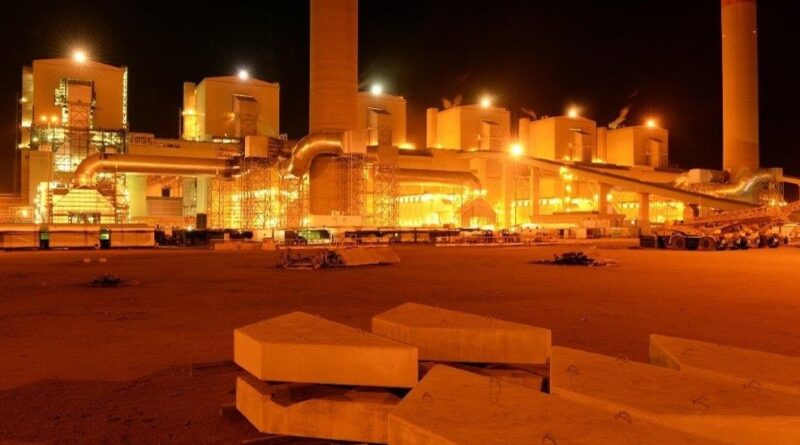

The South African government adopted a significantly lower carbon emission target ahead of last year’s COP26 climate conference and is aiming to reach net-zero status by 2050. But a delay in implementing higher charges may lead to a reduction in Eskom’s proposed increase in power prices, which could curb inflation. Eskom accounts for about two-fifths of South Africa’s emissions of climate-warming gases and the country is the world’s 12th biggest emitter.

The tax policy approach is aligned to global institutions, Treasury indicated in the budget document. The World Bank, for example, recommends carbon prices of $40 (R600) to $80 (R1 200) per ton by 2025 and $50 (R750) to $100 (R1 500) per ton by 2030. The International Monetary Fund recommends “lower minimum” carbon prices for developing countries of $25 (R370) to $50 (R750) per ton by 2030.

Treasury has encouraged companies to develop plans to reduce their emissions over the next 10 years, or they will face “steep” hikes.

The Minerals Council of South Africa welcomed the extension of the first phase of the carbon tax. Mining companies have a pipeline of 3.9 GW of renewable energy projects. Government needs to approve these to reduce their exposure to Eskom and its carbon-heavy electricity generation, noted the council’s chief economist Henk Langenhoven.