Harmony Gold Mining delivers stellar first quarter

Johannesburg – Harmony Gold Mining Company has reported operational update for the three months ended 30 September 2023 (Q1FY24).

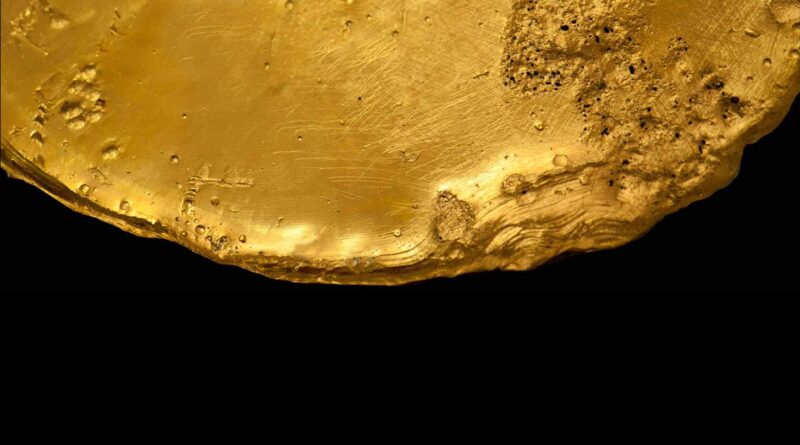

The first quarter saw a continuation of the strong operating performance across all our operations, resulting in higher gold production and outstanding operating free cash flows. This was mainly due to higher average underground recovered grades from our South African underground operations alongside a very strong quarter from the Hidden Valley mine in Papua New Guinea.

Average recovered grades at the South African underground operations increased by 18% to 6.29g/t for the Q1FY24 reporting period from 5.35g/t in Q1FY23. The higher underground recovered grades were underpinned by our high-grade Mponeng and Moab Khotsong operations.

Recovered grades at the Hidden Valley mine have remained high since we intercepted the high-grade ‘Big Red’ part of the ore body in the fourth quarter of the previous financial year (Q4FY23). Recovered grades at Hidden Valley therefore increased by 74% year-on-year to 1.76g/t from 1.01g/t in Q1FY23.

Group gold production in Q1FY24 increased by 17% to 13 223kg (425 130oz) from 11 301kg (363 336oz) in Q1FY23 with almost all our operations delivering higher production year-on-year. We are confident this good momentum will continue on the back of improved flexibility.

Silver production from Hidden Valley increased by 55% to 30 914kg (993 914oz) from 19 955kg (641 579oz) in Q1FY23. The average silver price received also increased by 35% to R14 157/kg (US$23.59/oz) from R10 514/kg (US$19.21/oz) in Q1FY23. As a result, we generated R433 million (US$23 million) in silver revenue at Hidden Valley.

Uranium is a by-product from the gold extraction process at Moab Khotsong. This quarter, uranium production increased by 50% to 70 044kg (154 420lb) from 46 710kg (102 978lb) in Q1FY23. Uranium sold increased 116% to 92 987kg (205 000lb) from 43 091kg (95 000lb).

Year-on-year, the average uranium price received increased by 24% to US$58.21/lb from US$47.01/lb, resulting in uranium revenue of R223 million (US$12 million) for the quarter.

The rand gold price remained favourable, increasing by 18% to R1 127 208/kg (US$1 881/oz) from R955 010/kg (US$1 743/oz) year-on-year. The strong rand/kg gold price continues to provide Harmony with a significant tailwind.

Gold revenue increased by 33% to R14 781 million (US$793 million) this quarter from R11 137 million (US$654 million) in Q1FY23.

Harmony Gold continues to manage costs carefully and is pleased that all its cost metrics per unit are lower year-on-year – in both rand and US dollar terms

- as a result of the higher recovered grades, low-cost surface retreatment production and higher by-product credits from silver and uranium.

- Cash operating costs in Q1FY24 decreased by 6% to R711 999/kg (US$1 188/oz) from R756 166/kg (US$1 380/oz) in Q1FY23

- All-in sustaining costs (AISC) decreased by 7% to R841 436/kg (US$1 404/oz) from R907 573/kg (US$1 657/oz) in Q1FY23

- All-in costs (AIC) decreased by 5% to R900 505/kg (US$1 503/oz) from R946 228/kg (US$1 727/oz)

Group operating free cash flows increased by 278% in Q1FY24 to R3 236 million (US$174 million) from R857 million (US$50 million) in Q1FY23. Group operating free cash flow margins increased to 22% in this reporting period from 8% in Q1FY23.

The Company’s balance sheet has continued to strengthen this quarter as it reduced our net debt to R117 million (US$6 million) from R2 726 million (US$145 million) at the end of the 2023 financial year. Net debt to EBITDA ratio is 0.0 times from 0.2 times in the previous quarter.

Harmony Gold has an extensive project pipeline to help it achieve its goal to improve the quality of its ounces and expand its margins as Harmony Gold transforms into a global gold-copper producer.

Harmony Gold is on track with the key projects in execution. These include the tailings storage facility expansion at Mine Waste Solutions and the Zaaiplaats project which is the life of mine extension at Moab Khotsong.

Newmont Corporation has joined Harmony as partner in the Wafi-Golpu Joint Venture effective 7 November 2023, following the conclusion of the Newcrest Mining Limited acquisition.