MC Mining experienced coal revenue growth due to strong sales

MC Mining in its interim financial report for the six months ended 31 December 2023 says the company experienced revenue growth from the prior corresponding period, primarily due to strong sales volumes at Uitkomst and the recommencement of operations at Vale.

Overall, MC Mining demonstrated an 80% increase in revenue to $25.2 million (FY2023 H1: $14.0 million) despite the 58% decline in average API4 thermal coal prices for the six months to $112/t (FY2023 H1: $265/t);

- Uitkomst’s sales volumes were 94% higher at 202,715t (FY2023 H1: 104,855t) of coal during the six months, generating revenue of $16.3 million (FY2023 H1: $14.0 million). The 58% decline in average coal prices resulted in the colliery’s revenue only improving by 16%;

- Operations at Vele Aluwani Colliery recommenced in December 2022 but the depressed API4 prices during the period impacted Vele’s revenue ($9.0 million vs. FY2023 H1: nil);

Despite the increase in revenue, the Company saw an increase in overall Cost of Sales primarily as a result of higher volumes of coal sold at Uitkomst and the recommencement of operations at Vele.

Group Cost of Sales for the six months was $24.1 million (FY2023 H1: $10.1 million). The increase in sales volumes resulted in Uitkomst’s cost of sales increasing by 45% to $14.8 million (FY2023 H1: $10.1 million); During the period, MC Mining achieved a gross profit of $1.1 million (FY2023 H1: gross profit of $3.9 million);

The loss after tax for the period was $5.8 million (FY2023 H1: loss after tax of $1.3 million) with the movement primarily due to $2.4 million reduction in the Uitkomst Colliery’s gross profit due to 58% lower average international coal prices; and $1.9 million increase in employee costs compared to FY2023 H1, primarily attributable to one-off employee benefits payments during the period, as well as an increase in the number of staff to facilitate the development of the Makhado Project and recommence operations at Vele.

Godfrey Gomwe, Managing Director & Chief Executive Officer, commented: “The strong revenue growth through the period was very pleasing given the challenging coal market conditions. Our ability to continue to move product is important and we are seeing some signs of increased demand from thermal coal buyers. Although having some impact on our overall result, we continued to make worthwhile, long-term investment decisions in our flagship Makhado Project, which we believe will benefit shareholders in the future. The Company achieved these results whilst maintaining a focus on safety with no incidents recorded during the period.

Production at the underground Uitkomst Colliery is challenging due to the extended travel time to the mining areas but the optimisation plan implemented in June 2023 has resulted in increased mining time and ROM coal production and sales volumes increased significantly. These results were achieved despite the ongoing electricity load shedding implemented by Eskom, the state power utility. The international and domestic thermal coal markets remain under pricing pressure, resulting in considerably lower sales prices achieved during the period.

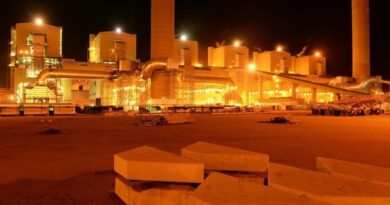

The Company continued to progress the Makhado Project, with the commencement of early works to secure the site and construction of a bridge across the Mutamba river along with water infrastructure for the processing plant. We also launched managed tender processes to select outsourced mining, plant and laboratory operators at Makhado. We have also commenced assessing various scenarios to facilitate an accelerated start of coal production at Makhado, subject to further funding, with no impact to the existing project plan. We will provide further updates in due course.

The significant progress on the Makhado Project over the last two years has resulted in a development plan that can be implemented within a short period once the necessary funding is secured. We progressed the funding initiatives during the period and were at an advanced stage of securing the cornerstone funds for the development of the project, prior to being notified of the off-market takeover corporate action. This funding would have been the catalyst for the composite equity and debt funding required for the construction of Makhado.

Operation at the Vele Aluwani Colliery continued during the six months and in December 2023 the outsource agent notified the Company in December 2023 that due to production challenges at the colliery, combined with elevated logistics costs and the depressed API4 coal price, it intended downscaling operations at the colliery while it progressed a production optimisation strategy.

We progressed the regulatory status of the Group’s long-term Greater Soutpansberg exploration projects with the legal execution of mining rights for the Mopane and Generaal project areas. We anticipate executing the Chapudi mining right in CY2024 H1, with the required studies for the project commencing later in CY2024.”