Mechanised mining operation + high PGM grades = low unit costs

It’s a very risky deal says an expert on African Rainbow Minerals’ (ARM) announcement to acquire all the shares in Bokoni Platinum Mines (Pty) Ltd, which is 49% owned by a subsidiary of Anglo American Platinum (Amplats) and 51% owned by a subsidiary of Atlatsa Resources Corporation.

This mine commenced operations in 1969 but has been under care and maintenance since October 2017 due to “unfavourable market conditions” (the wording in the ARM announcement) or “several years of significant cash losses under difficult market conditions” according to the Amplats announcement which doesn’t sugar-coat it either.

ARM will need to develop the mine in coming years and only expects to achieve steady-state production by 2028, which is perilously close to when some people believe the internal combustion vehicle will die off.

The Bokoni mine has the second largest PGM resource in South Africa. It has a measured, indicated and inferred resource of 153 million 4E PGM ounces. The measured resource is 55 million ounces. 64% of the resource is UG2 grade, which has a split of 49% palladium, 41% platinum and 8% rhodium. This is where ARM will focus its attention.

There is significant infrastructure in place, which ARM plans to use as part of its business plan for the asset. The development of Bokoni will create 5,000 jobs, of which 2,500 are expected to be permanent. Local communities, employees and Black industrialists will own 15% of the mine.

The deal is worth R3.5 billion, to be paid in cash. ARM has sufficient existing cash resources to fund the transaction and expects to invest another R5.3 billion over three years to mechanise the mine and move ARM down the PGM cost curve.

A Sale of Concentrate Agreement has been entered into between Bokoni and the Amplats subsidiary, covering a contractual period of 23 years. Mining operations will only commence in 2023, as a Definitive Feasibility Study is required along with the extensive regulatory approvals for the mine to transfer.

BPM is a platinum group metals (“PGM”) mining operation located in the Limpopo Province of South Africa and forms part of the North-Eastern Limb of the Bushveld Complex. BPM has the second largest PGM resource in South Africa and as of 31 December 2020 had measured, indicated and inferred mineral resources of 153 million 4E PGM ounces with a grade of 5.87 g/t. Based on the acquisition price of R3.5 billion this translates to an imputed acquisition price of R22.88 per 4E PGM mineral resource ounce.

As at the same date BPM’s measured resource totalled 55 million 4E PGM ounces with a grade of 5.92 g/t. Within the measured category of resources, UG2 accounts for 41 million 4E PGM ounces with a grade of 6.43 g/t.

BPM’s total mineral resource comprise of approximately 64% UG2 and 36% Merensky. The UG2 is of a much higher grade than the Merensky (6.56 4E g/t versus 4.94 4E g/t) and the UG2 mineral resource has a favourable prill split for palladium (49%) and rhodium (8%) with platinum comprising 41% on a 4E basis.

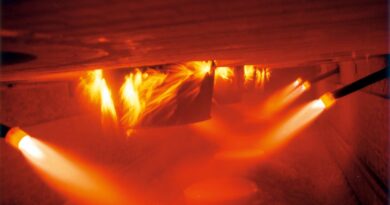

BPM comprises mining infrastructure of two decline production shafts namely Brakfontein Shaft for the extraction of Merensky ore and Middelpunt Hill Shaft for the extraction of UG2 ore. In addition, the operation has two concentrator plants, one for UG2 and the other for Merensky processing; a village, a clinic and ancillary assets within the mining right area. ARM plans to use both existing shafts and plant infrastructure and invest in new infrastructure as part of its new business plan to mechanise BPM.

For the last operational financial year ending 31 December 2016, BPM produced approximately 159 000 4E PGM ounces. At the time, the mine was predominantly mining the Merensky reef with annual production output of 593 000 tonnes from Brakfontein and UG2 output from Middelpunt Hill of 572 000 tonnes.

For the financial year ended 31 December 2020, BPM’s net liabilities being acquired was R1,279 million. Over this period, BPM was on care and maintenance and incurred a loss after tax of R163 million.