Ten key developments in the metal and oil industries in 2022

Wood Mackenzie says its 2021 predictions stood the test of time pretty well. Crude prices rose, more oil and gas companies set objectives for cutting emissions, the pace of consolidation in the US upstream industry picked up, and China’s restrictions on imports of Australian coal remained in place; all as Wood Mackenzie analysts predicted.

For 2022, Wood Mackenzie has another ten predictions, covering the range of Wood Mackenzie’s expertise in sectors including carbon markets, power, oil and gas, and metals and mining. Some relate to short-term cyclical factors; others reflect long-term trends that are going to play out over decades.

The rapid rise of the Omicron variant of the Covid-19 virus has cast a shadow over the outlook, dashing hopes that we could be confident of steady progress out of the pandemic. But as this year has shown, many of the fundamental trends driving the energy and natural resources industries remain highly resilient, even in the face of a global health crisis.

Against that backdrop, here are the ten predictions for specific markets and sectors in 2022:

1) Carbon prices around the world will reach new highs

Carbon prices in compliance markets, including the EU’s Emissions Trading System and China’s National Emission Trading Scheme, will continue to increase in 2022, driven by long-term climate policy fundamentals. To support their decarbonisation pledges, governments will also continue to increase the rates of existing carbon taxes, and introduce new ones. On the voluntary carbon markets, meanwhile, corporate ambitions to achieve net-zero targets will drive demand for high-quality offsets; prices will continue to soar.

2) Distributed solar installations will grow significantly in 2022, and drive the adoption of other distributed energy resources

Developing distributed solar capacity will be an objective for policy makers in many important markets around the world. China will continue its ongoing effort to increase dramatically the utilisation of distributed solar in its rural areas. Germany’s new coalition government has a target of installing 200 gigawatts of solar by 2030, which will rely heavily on residential solar resources. And distributed solar will remain the dominant model in Japan, Australia, Belgium, and Poland.

In the coming year, policymakers and energy service providers around the world will also increasingly leverage the growing distributed solar fleet to support grid stability and provide flexibility. This means the US, for example, will continue to see distributed solar combined with storage and / or electric vehicle charging infrastructure. More Australian households will add storage to their rooftop solar systems to hedge against the rising cost of interconnection and lower solar electricity export tariffs. And more countries will use distributed solar and energy storage to bring electricity services to disadvantaged communities.

3) China’s power surge will tighten renewable energy supply chains

China’s economic growth at over 8% in 2021 fired up soaring power demand: China’s electricity consumption grew by 10%, which was the fastest annual growth for any major economy in the recorded history of the industry.

This has led to a massive surge in wind and solar investment in China, and given that the country accounts for over 50% of wind turbine manufacturing capacity and almost 70% of all solar panel output, that will exacerbate the challenges facing already tight global supply chains for renewable energy in 2022.

Those challenges will be added to by Beijing’s unwavering commitment to its zero Covid policy: efforts to keep out the Omicron variant are likely to mean even more stringent border controls and quarantine measures in 2022. The difficulties that renewable energy developers worldwide have faced this year look set to increase.

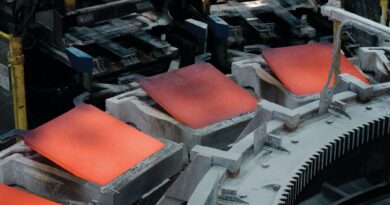

4) Economies that have committed to rapid reductions in greenhouse gas emissions will act to encourage increased local production of the metals that are critical for the energy transition

The major blocs that have made commitments to accelerated decarbonisation are likely to follow China’s lead and start supporting the development of supply within their own borders. A natural extension of these policies will be allowing investors, financers and miners to develop supply in the less favourable locales, to help ensure that the increased demand for metals resulting from their climate commitments can be met.

5) The market will not run short of oil in 2022

We project robust growth in oil demand for 2022 as global consumption continues its recovery to pre-pandemic levels, a milestone likely to be reached in the second half of the year. The risk to this forecast is on the downside, however. Covid cases are rising, with the new variant Omicron adding to the surge. While the use of lockdowns is not expected to be widespread, rising cases can slow demand growth through reduced travel especially international flights.

Turning to global oil supply, Wood Mackenzie forecasts an increase of over 4 million barrels per day for 2022, similar to the projected increase in demand. The US Lower 48’s recovery from the pandemic price collapse of 2020 has been slow, because the industry needed to pay off debt and boost dividends. In 2022 that is set to change, with increases in output from the Lower 48 contributing to stronger US production growth overall. Other non-OPEC producers are also on course for strong gains.

The net effect is we expect a more balanced market for 2022 and easing of concerns about potential supply shortages. The new year is projected to start out with a first quarter global implied surplus of around 1 million b/d.

6) The Permian will see a “Major” production bump

There is a good chance that Big Oil will be more nimble than its smaller rivals in the Permian Basin next year. ExxonMobil and Chevron already produce a combined 1.1 million barrels of oil equivalent per day in the Permian, and that number is going higher. ExxonMobil recently reaffirmed its end-2024 target of 700,000 boe/d.

Chevron is increasing its 2022 Permian budget by US$1 billion year-on-year. The independents are guiding toward strict financial targets, with 2022 production as an outcome. The Majors, however, are still holding to their projections for output volumes alongside their financial objectives.

Growing Permian production also fits with the Majors’ new lower-carbon strategy frameworks, including ExxonMobil’s Permian Net Zero 2030 goal. It might seem counter-intuitive on the surface, but it is the logical conclusion: the Majors should ramp Permian activity more than their competition. According to our models, they will need considerably more rigs running to hit those production targets.

7) Electric vehicles will take a double-digit share of the global market for the first time ever

Internal combustion engine vehicles have not been challenged to this degree since the days of the Ford Model T. Some government support for EVs will weaken in 2022: Europe will continue rolling back its EV “super-credits”, and China plans to tamp down EV subsidies. But despite this, global EV sales are projected to top 8.5 million. Combined with the lingering effects of the chip shortage impacting conventional car sales, EVs are set to take a bigger share than ever next year. The US is expected to continue to lag behind, however. The Biden administration is attempting to increase the tax credit for EVs to US$ 12,500, but this will continue to be applicable only to a small number of vehicles as the limits for individual manufacturers have not been lifted. The share of EVs in the world’s second-largest car market will climb to a lukewarm 6%.

8) Oil and gas companies will increasingly move beyond wind and solar for their low carbon strategies, as their ambitions in hydrogen and carbon capture grow

Oil and gas companies will invest record levels into new energy next year, and the strategic narrative will broaden out. For the European Majors, the focus of attention and capital investment has largely been on wind and solar. But in 2022, Carbon Capture, Utilisation and Storage, and low-carbon hydrogen, will move from growing ambition to meaningful commitment. First movers will mobilise significant resources as they jostle for position in the future battlegrounds of these longer-dated technologies. Hoppers will be filled with low-carbon projects, new partnerships will emerge, and the leaders will start to turn strategic intent into firm actions.

9) The US government will commit to increased support for low-carbon hydrogen

The Build Back Better Act currently making its way laboriously through Congress includes a production credit of up to US$3 per kilogram for low-carbon hydrogen. If it passes, it will help make green hydrogen highly competitive against grey hydrogen in some parts of the United States, especially in states with strong wind and solar resources.

The act also includes increases in the 45Q tax credit that will support blue hydrogen projects. The future of the legislation is still uncertain. Centrist Democratic senators have been pushing back on spending across the board. But if the US wants to be a leader in hydrogen and make real progress on decarbonising its economy, it will have to put policies in place to assist the industry in its early stages. Even if the Build Back Better Act fails to pass the Senate in its current form, some increased support for low-carbon hydrogen is very likely to emerge.

10) Chinese government controls will drive down seaborne thermal coal prices

After a coal shortage and price spike in the second half of this year, China opened the floodgates on domestic production. Monthly output hit all-time records towards the end of the year, with production rates increasing 10% in a quarter. As stockpiles at generation companies get replenished, we expect the government to crack down on coal imports by enforcing stricter quotas. China will also set domestic coal prices lower, ratcheting down prices in the seaborne coal market, where its 25% share of total demand wields significant influence.