Myanmar crisis threatens rare earth market

The on-going unrest in the country since the military coup d’état at the start of February, the trade of products across the border with China are being impacted, disrupting the rare earth supply.

The conflict in Myanmar has escalated significantly in recent weeks, with multiple deaths being reported across the country and protestors ransacking Chinese-owned businesses after accusations that Beijing had supported the coup.

Presently, disruption to the transportation of material is stated as being the main cause of delays to trade across the border between Myanmar’s Kachin state and China’s Yunnan province.

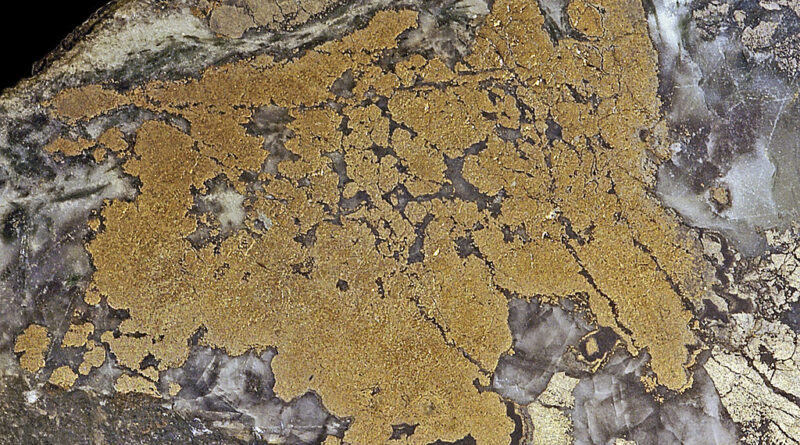

The often-fragile relationship between local militia and state military, which allows the rare earth mines in Kachin to operate freely, is also being placed under increasing strain, which has the potential to reduce Myanmar’s rare earth production sharply and swiftly. Myanmar has become a vital source of raw materials for processors in Southern China, with domestic production of heavy rare earth (HREE) ores and concentrates in China also largely mothballed.

Disruption to the supply of rare earth ores, concentrates and semi-processed products between Myanmar and China has the potential to create significant supply chain issues for processors in southern China.

Roskill says all ionic adsorption clay (IAC) mining operations, including those who had operated throughout in 2020, asked to be suspended in late February, and there are no signs of any re-start yet. The proposed introduction of ammonia-free in-situ leaching technology at various IAC projects in China has not materialised over continued concerns regarding pollutants, recovery rate and social impacts.

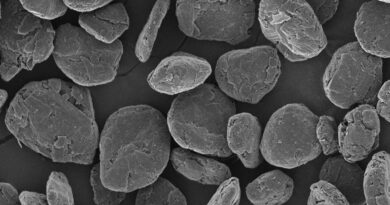

This means that there are very few operational alternatives to Myanmar-derived production of HREEs such as dysprosium and terbium, with viable sources either only in pilot scale production or producing mixed HREE products as a by-product of Nd-Pr.

In 2020, Myanmar accounted for 39% of global HREE mine production, with China itself the only other major producer of HREE mined products at 48% of global supply. In comparison, the next largest producer of HREE mined products was Lynas Corporation at roughly 5.5% global supply.

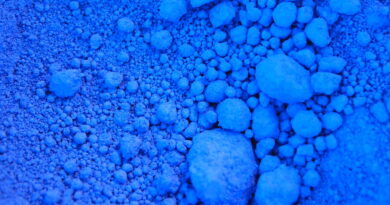

There are reported to be stockpiles of refined HREEs, including dysprosium and terbium compounds, held by both private and public inventories, which could be drawn down in China, though without primary production these inventories would soon become depleted.

As a result of the growing uncertainty and tight supply availability in China, prices for dysprosium and terbium are expected to be supported at higher levels, following the strong price performance observed during 2020 and Q1 2021.

This will result in better economic performance for many projects under development and further incentivise investment in capacity. Investors should be weary, however, that the payability of certain rare earth products will be unaffected by higher Dy and Tb prices, particularly those with dominant light rare earth (LREE) content.

Though with the potential for significant supply deficits to form for many HREEs if Myanmar production is heavily disrupted for an extended period, even LREE products may see increased payability for certain HREEs.

Roskill’s Rare Earths: Outlook to 2030, 20th Edition report was published in January 2021.