Private energy may buoy South African ferrochrome

South Africa’s Department of Mineral Resources and Energy (DMRE) announced the selection of its preferred bidders for the Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP).

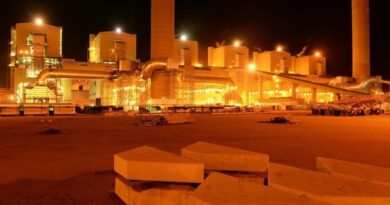

The programme is aimed at supplementing state-owned power utility, Eskom’s energy production with independent power producers (IPPs), to meet the immediate electricity supply gap. The DMRE aims to introduce an additional 2,000MW of power into the national grid by August 2022, through the programme.

This development comes against a backdrop of rising electricity tariffs and poor grid reliability, which have weighed on the competitiveness of South Africa’s ferrochrome industry.

As of 2012, the South African ferrochrome industry lost its status as the world’s largest producer with China progressively gaining market share, to account for 45% of global production in 2020 compared to South Africa’s 21%. Roskill says this shift unfolded as rising electricity costs and poor grid reliability eroded the competitiveness of South African producers.

In Q4 2020 the South African government announced the approval of chrome ore export tax, in addition to measures incentivising the usage of energy efficiency technology on smelters and support for electricity self- and co-generation.

These measures were aimed at supporting the ferrochrome industry, to prevent further loss of market share and support growth, although no further indications on an export tax have been released for 2021.

Roskill’s analysis demonstrates that an ore export tax should have the desired effect of boosting the competitiveness of the domestic ferrochrome industry. However, any benefit from an export tax can be quickly eroded by further electricity tariff increases in the pipeline, including a 15% increase effective from 1 April 2021.

Moreover, an export tax does not address the country’s power supply deficit, which will need to be resolved to accommodate resurgence in domestic smelting capacity.

The latest developments may be viewed as tangible progress in developing sufficient generation capacity to support growth in the ferroalloys sector and, on that basis, will likely be welcome by the industry. Moreover, government-led policy reform in China may provide an optimal opportunity for growth in production capacity outside of China.

With new energy control measures triggering the closure of old, inefficient furnaces in China’s Inner Mongolia region, a drop in capacity utilisation in the ferrochrome producing hub is set to curtail output as the country’s ferrochrome sector aims to phase-out this capacity by 2022.

In this context, renewed growth in ferrochrome output, both in South Africa and elsewhere may be ripe for the picking – particularly as stainless steel demand looks set to rebound in 2021 and continue with a steady growth over the next decade.

Roskill will publish its NEW Chromium: Outlook to 2031, 17th Edition report in June 2021.