Rio Tinto to acquire full ownership of Turquoise Hill

LONDON – Rio Tinto has made a non-binding proposal to the Turquoise Hill Board to acquire the approximately 49% of the issued and outstanding shares of Turquoise Hill that Rio Tinto does not currently own. Under the terms of the Proposed Transaction, Turquoise Hill minority shareholders would receive C$34 in cash per Turquoise Hill share, representing a premium of 32% to Turquoise Hill’s last closing share price on the Toronto Stock Exchange. This proposal would value the Turquoise Hill minority share capital at approximately US$2.7 billion.

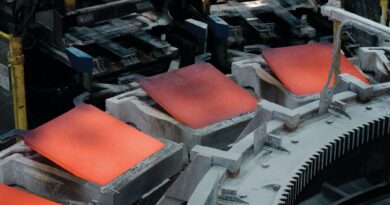

The Proposed Transaction follows the recent comprehensive agreement reached between Rio Tinto, Turquoise Hill and the Government of Mongolia to move the Oyu Tolgoi project forward, reset the relationship between the partners and approve commencement of underground operations. It would simplify the Oyu Tolgoi ownership structure, strengthen Rio Tinto’s copper portfolio, and reinforce its long-term commitment to Mongolia.

In addition, the Proposed Transaction provides Turquoise Hill minority shareholders with the ability to realise compelling, immediate and certain value for their shares at a time when uncertainties inherent in the development of the underground operations and funding of such development remain.

Rio Tinto Chief Executive Jakob Stausholm said “Rio Tinto strongly believes in the long-term success of Oyu Tolgoi and Mongolia, and delivering for all stakeholders over the long-term. That is why we want to increase our interest in Oyu Tolgoi, simplify the ownership structure, and further strengthen Rio Tinto’s copper portfolio. We believe the terms of proposal are compelling for Turquoise Hill shareholders.

“The Proposed Transaction would enable Rio Tinto to work directly with the Government of Mongolia to move the Oyu Tolgoi project forward with a simpler and more efficient ownership and governance structure. With our relationship reset and the underground operations commenced, this transaction demonstrates our clear and unequivocal long-term commitment to Mongolia.”

Rio Tinto looks forward to working constructively with the Turquoise Hill Board to progress the Proposed Transaction. Should Turquoise Hill investors not accept the Proposed Transaction, Rio Tinto welcomes their continued investment and equal share of future risks and funding obligations.

Rio Tinto’s proposal to the Turquoise Hill Board will be filed promptly with the Securities and Exchange Commission in accordance with applicable laws and regulations in the United States. The Proposed Transaction, which is expected to be conducted by way of a Canadian plan of arrangement, will be subject to customary closing conditions, including approval by a majority of the votes cast by Turquoise Hill minority shareholders. The Proposed Transaction is not subject to any financing condition or due diligence.

No agreement has been reached between Rio Tinto and Turquoise Hill, and there can be no assurance that any transaction will result from these discussions. Even if a transaction is agreed, there can be no assurances as to its terms, structure or timing.

Given Rio Tinto’s approximately 51% ownership in Turquoise Hill, the Proposed Transaction will be required to follow the rules set out in Canadian Multilateral Instrument 61-101 – Protection of Minority Shareholders in Special Transactions.

This will require, among other things, a Special Committee of the Turquoise Hill Board, which will not include any Rio Tinto nominees, to assess the terms of the Proposed Transaction. As part of that assessment the Special Committee will need to obtain a formal valuation of the common shares in Turquoise Hill by an independent valuator.

With the Special Committee’s support, and after completion of the independent valuation and agreement between Rio Tinto and Turquoise Hill on the terms and conditions of the transaction, Turquoise Hill will schedule a meeting of its shareholders to approve the transaction.

The transaction must be approved by a vote by (i) holders of 66 2/3% or more of the Turquoise Hill shares, and (ii) a majority of the Turquoise Hill minority shareholders, in each case of those shares voted at the meeting.

If the Proposed Transaction is successful Rio Tinto will hold a 66% interest in Oyu Tolgoi with the remaining 34% owned by Mongolia. The valuation of Turquoise Hill minority shareholdings at US$2.7 billion is based on a Canadian dollar exchange rate of US$0.7874 as at 11 March.