Sibanye Stillwater significantly advances its green metals strategy

Sibanye Stillwater has significantly advanced its green metals, announcing two transactions during Q3 2021 and two further transactions during the past week. In summary:

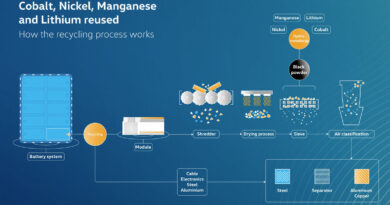

- On 30 July 2021 the proposed acquisition of 100% of Eramet’s Sandouville nickel processing facilities in Le Havre, France for an effective cash cost of Euro 65 million, was announced. This existing hydrometallurgical facility which is already zoned for heavy industrial purposes, is scaleable for nickel, cobalt and lithium battery grade products with potential to introduce recycling operations, and will provide strategic access to extensive logistical infrastructure supporting future supply of battery metal products into the European end user markets

- On 16 September 2021 a proposed 50:50 joint venture (JV) with ioneer with respect to ioneer’s Rhyolite Ridge Lithium-Boron project in Nevada, USA, was announced. In terms of the proposed transaction, Sibanye-Stillwater will, after various conditions have been met and relevant permits have been obtained, contribute US$490 million for a 50% interest in the JV and subscribe for a 7.1% direct equity share in ioneer for approximately US$70 million. Rhyolite Ridge is a world-class lithium project with the potential to become the largest and lowest cost lithium mine in the US and is strategically positioned close to the rapidly developing battery production facilities in the region

- On 26 October 2021, the proposed US$1 billion acquisition of the low cost Santa Rita nickel and Serrote copper mines in Brazil from Appian Capital, was announced. The transaction represents a unique opportunity for Sibanye-Stillwater to acquire significantly pre-developed and pre-capitalised, low-cost, producing nickel and copper assets with strong ESG credentials and will provide a platform for growth in South America. The assets will continue to be managed by the existing high-quality team which has a wealth of operating experience in Brazil

- On 27 October the proposed acquisition of a 19.9% stake in New Century, a leading Australian tailings reprocessing Group for a maximum cash consideration of US$46 million, was announced. This transaction represents a significant next step in our strategy of building a leading global tailings retreatment business, diversified by commodity and geography, which is a critical element in building its portfolio of green metals, and complements the position Sibanye Stillwater has established in the mineral resources circular economy through its investment in DRDGOLD.

These transactions are the outcome of over two years of detailed analysis of the battery metals markets and provide the Group with a solid initial platform for sustained value creation establishing it as a meaningful participant at a formative stage in the growth of the future green global economy.