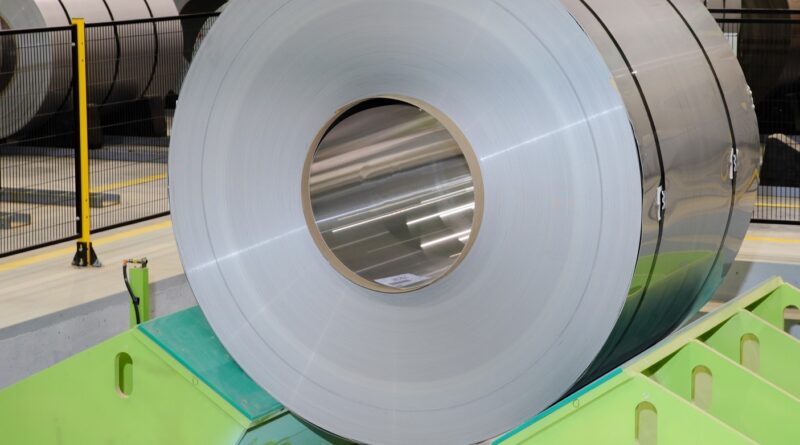

Stainless steel – largest consumer of nickel in 2020, 2021

According to Roskill, the nickel market in 2020 was strongly impacted by the global slowdown caused by the COVID-19 pandemic. Lockdown measures were implemented across the globe to slow the spread of the virus, which resulted in a reduction of end-use demand for nickel products.

In spite of the impact to demand, nickel supply remained relatively unaffected and saw estimated growth of 4% in 2020. This was almost entirely the result of surging supply of refined nickel from Indonesia. As a result, the nickel market switched to surplus for the first time in four years.

Consumption of primary nickel has risen strongly over the past decade, although demand declined y-o-y in 2020 for the first time since the global financial crisis (GFC) as a result of the COVID-19 pandemic.

Stainless steel demand was initially impacted by the disruptions caused by repeated lockdowns to mitigate the spread of COVID-19, which had negative consequences on construction and the hospitality sector. Large downturns for the aviation and automotive sectors reduced nickel demand in nickel alloys and castings respectively.

The nickel price averaged US$13,771/t in 2020, which was marginally down on the average for 2019. However, this does not highlight the large price movement over the year, starting with an early slump that was followed by a strong rally over the second half of 2020, despite the market surplus.

At the beginning of 2020, Indonesia reimposed its ban on the export of unprocessed nickel ores and concentrates to attract further investment in constructing processing capacity, after having successfully increased market share following a similar export ban in 2014.

The move once again has been largely successful, with nickel pig iron (NPI) supply estimated to have soared by a staggering 67% y-o-y in 2020. As a result, however, the loss of material available for processing in China led to fears of a decline in domestic NPI production, amid a stimulated Chinese economy and healthier stainless steel demand over H2 2020.

Remarks by Tesla CEO, Elon Musk, demanding more sustainably sourced nickel have provided additional support to the bullish narrative for nickel. Batteries will find a growing market share for nickel over the next decade, although this currently represents a small proportion of nickel consumption.

Numerous high-pressure acid leach (HPAL) projects are being constructed in Indonesia to serve the growing demand for intermediates used in nickel sulphate production. Slowing the development of these projects has been a change in plans for their tailings disposal methods.

Initially these projects had planned to utilise deep sea tailings placement, but in October2020, under pressure from concerned stakeholders along the supply chain, they have opted against this method in favour of on-land tailings storage.

With sustainability concerns ranging from the large areas of land clearance involved in nickel laterite mining to the high energy consumption involved in nickel smelting, Roskill believes that ESG will become an increasingly significant component of the nickel market over 2021 and the years to come.

Roskill forecasts stainless steel to remain the main application for nickel over the course of the next decade driven by continued growth in demand from China. Low use of nickel in scrap by Chinese and Indonesian stainless steel mills will continue to drive consumption of nickel in primary units.

However, eating into stainless steel’s share of the nickel market over the next decade, will be lithium-ion batteries used in electric vehicles that will see rapid uptake over the next decade.

Due to the rising demand for nickel products suitable for processing to nickel sulphate including Class I nickel, this is likely to impact stainless steel mills as they increasingly substitute such high-purity nickel for Class II nickel and scrap.

Roskill’s New Nickel Outlook 17th edition provides a comprehensive insight into the trends and likely future direction of the primary nickel market.