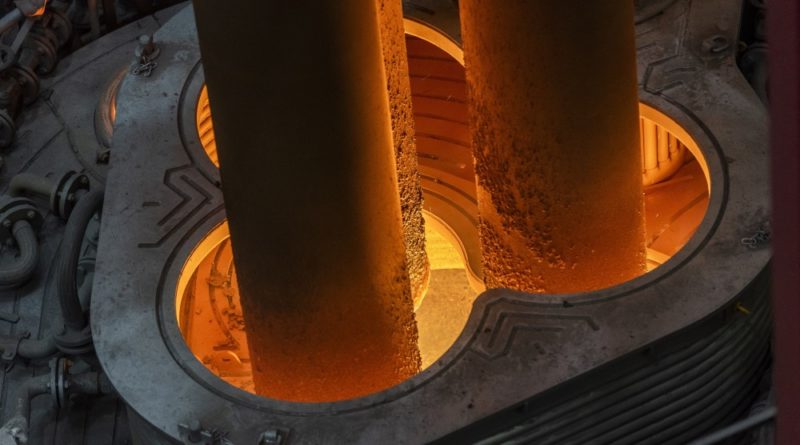

Steel production: Globally down by 6%, SA up by 11% to 4,9m tonnes

Global crude steel production remained flat for 2023, at 1 888 million tonnes. Global crude steel production decreased by 6% in H2 2023, compared to the preceding six months.

China’s crude steel production remained flat at 1 020 million tonnes, retaining its market share at 54% (2022: 54%). Europe’s crude steel output decreased by 7% to 168 million tonnes. North America decreased by 2% to 110 million tonnes, and Turkey decreased by 3%. Russia increased its output by 6%, and India increased by 12% to 140 million tonnes.

Africa’s output increased by 5% to 22 million tonnes mainly due to increased production in South Africa, Libya and Egypt. South Africa’s crude steel production increased by 11% to 4,9 million tonnes.

The South African steel market is experiencing real demand weakness with low to negative growth in construction (+1,6%), manufacturing (+0,8%), machinery and equipment (+2,9%), mining (+0,2%), agriculture (-3%) and electricity, gas & water (-4.6%)

Outlook for the first half of 2024

Internationally, the World Steel Association expects a 1,9% increase in steel demand, with China continuing to play a directional role in international steel demand and pricing trends.

Prices are unlikely to remain at current low levels based on international spreads being under extreme pressure.

For the Longs Business, the key focus for the first half of 2024 will be to progress and conclude the short-term initiatives, while work with Government, customers, suppliers, labour and other stakeholders continues to consider and implement the medium-and longer-term structural changes necessary to ensure a level playing field and the sustainability of the South African steel industry.

Within the Flats Business, the focus will be to increase volumes and optimise operational efficiency, while further improving reliability and quality for the benefit of our customers.

Exchange rates will continue to have an impact as will rail service and electricity reliability.